ICICI Lombard General Insurance Company has opened its initial public offering of 8.62 crore equity shares for subscription on Friday, with a price band of Rs 651-661 per share.

Equity shares are proposed to be listed on BSE and NSE. The issue will close on September 19.

The global coordinators and book running lead managers to the offer are DSP Merrill Lynch, ICICI Securities and IIFL Holdings while the book running lead managers are CLSA India, Edelweiss Financial Services and JM Financial Institutional Securities.

Here are 10 things you should know before you invest in IPO:-

Company Profile

The general insurance company offers a comprehensive and well-diversified range of products, including motor, health, crop/weather, fire, personal accident, marine, engineering and liability insurance, through multiple distribution channels.

It was the largest private-sector non-life insurer in India based on gross direct premium income in fiscal 2017, according to the CRISIL Report.

The company was founded as a joint venture between ICICI Bank and Fairfax Financial Holdings, a Canadian based holding company through its subsidiaries.

In fiscal 2017, the company issued approximately 17.7 million policies and gross direct premium income was Rs 10,725 crore, translating into a market share of 8.4 percent among all non-life insurers in India and 18 percent among private-sector non-life insurers in India, according to the CRISIL Report. The market share in three months ended March 2017 stood at 10 percent and 20.2 percent (according to provisional data released by IRDAI), respectively.

ICICI Lombard has 16 group companies, including ICICI Bank Canada, FAL, ICICI Home Finance Company, ICICI Prudential Life Insurance Company and ICICI Securities.

About the Issue

The initial public offering of up to 8,62,47,187 equity shares comprises of an offer for sale of up to 3,17,61,478 shares by ICICI Bank and up to 5,44,85,709 shares by FAL Corporation.

The issue size also included a reservation of up to 43,12,359 shares for purchase by ICICI Bank shareholders. The offer would constitute 19 percent of post-offer paid-up equity share capital.

ICICI Lombard aims to raise Rs 5,614.7-5,700.9 crore through the issue, at a price band of Rs 651-661 per share.

Bids can be made for a minimum of 22 equity shares and in multiples of 22 equity shares thereafter.

Objects of the Issue

The company will not receive any proceeds from the offer.

The objects of the offer are to achieve the benefits of listing the equity shares of the company and to carry out the sale of up to 8,62,47,187 equity shares by the selling shareholders.

Financials

Its return on equity has exceeded 15.6 percent for each fiscal year since fiscal 2015. Profit after tax and return on equity were Rs 642 crore and 17.2 percent, respectively, in fiscal 2017.

Its solvency ratio stood at 2.13x as of June 2017 compared to the IRDAI-prescribed control level of 1.50x and an Indian non-life private-sector average of 1.95x, according to the CRISIL report.

Combined ratio of the company improved marginally from 104.9 percent in FY15 to 104.1 percent in FY17. During the same time period, its loss ratio improved from 81.4 percent to 80.6 percent.

For the three months ended June 2017, its combined ratio and loss ratio improved to 102.4 percent and 78.1 percent, respectively.

Competitive Strengths

ICICI Lombard has maintained consistent market leadership and demonstrated growth; has diverse product line with multi-channel distribution network; and robust risk selection and management framework.

The company has strong investment returns on a diversified portfolio. It has superior operating and financial performance.

Promoter

India's largest private sector lender ICICI Bank currently holds 28,56,05,284 equity shares, equivalent to 62.92 percent of the pre-offer paid-up equity share capital of the company and 21.91 percent stake is held by FAL (a nominee of Fairfax).

In June 2017, Fairfax made investment in Oben General Insurance that obtained an in-principle approval from IRDAI to form an insurance company in India. One of the conditions mentioned therein required Fairfax to reduce its equity holding in ICICI Lombard to below 10 percent.

Accordingly, in July, FAL transferred 12.19 percent stake in the company to certain private equity / financial investors.

ICICI Bank and FAL proposed to sell 7 percent and 12 percent stake in the company through an offer. After the issue, FAL's stake will reduce below 10 percent.

Shareholding

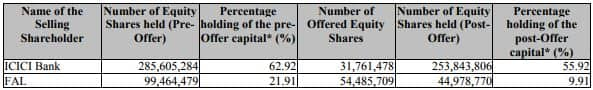

Here is shareholding of selling shareholders post issue:-

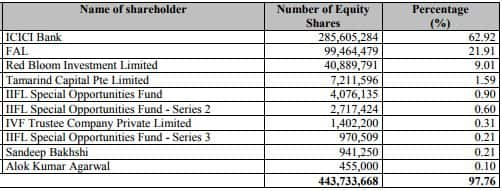

Here are top 10 shareholders of the company as of September 6, 2017:-

Two years prior to the filling of red herring prospectus, ICICI Bank and FAL's stake stood at Rs 72.88 percent and 25.61 percent, respectively.

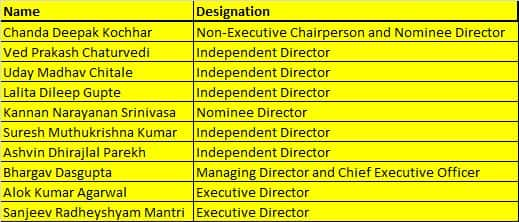

Management

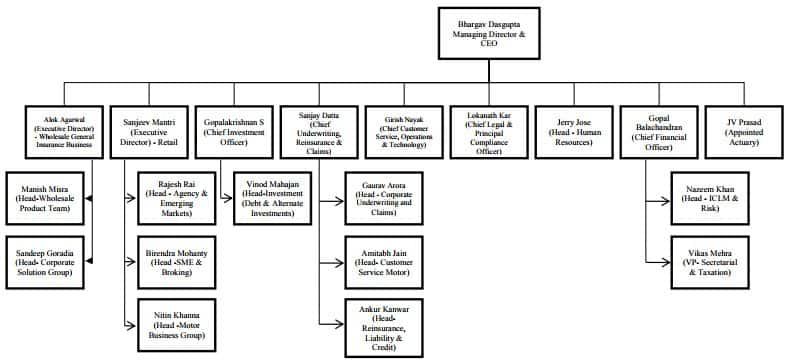

Management Organisation Chart

Dividend Policy

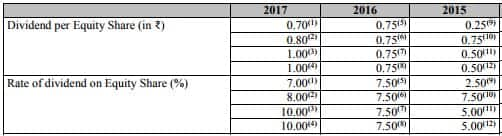

The company has paid cumulative dividends (exclusive of dividend distribution tax) of Rs 414 crore since fiscal 2015.

Its board members have also declared an interim dividend of Rs 0.75 per share for the quarter ended June 2017.

It paid out 18 percent, 32 percent, 29.5 percent and 19.1 percent of profit after taxes in the form of dividends in fiscal 2015, 2016, 2017 and for the three months ended June 2017, respectively. The company paid 12 interim dividends for last three financial years.

Risks and Concerns

Here are some risks and concerns pointed out by several brokerage houses:-

> High dependence on motor vehicle manufacturers and ICICI Bank for distribution;

> Over 22 percent business comes from government contracts which are subject to risks such as changes in government policies or regulations;

> Around 67 percent of reinsurance is ceded to GIC Re (General Insurance Corporation of India), any change in this relationship may result in difficulty finding alternative reinsurance at acceptable rates;

> Catastrophic events, including natural disasters, could materially increase liabilities for claims by policyholders; and have a material adverse effect on business, financial condition and results of operations.

> The insurer is exposed to significant market risk, including changes in interest rates or adverse movements in the equity markets in India that could impair the value of the investment portfolio;

> Loss reserves are based on estimates of future claims liabilities and if they prove to be inadequate, it could lead to further reserve additions and adversely affect result of operations;

> The company relies on selected insurance types for most of the GDPI (gross domestic premium income) and profitability;

> A portion of the company’s corporate premium comes from a limited number of large clients and the loss or downsizing of any of these clients could adversely affect the business, results of operation, financial condition and cash flows;

> Geographical concentration - In FY17, Maharashtra, Madhya Pradesh and the National Capital Territory of Delhi, together accounted for 47.6 percent of GDPI.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!